|

||

|

|

Year 4 Issue 7 August 2005 | |||

| Change the course : "20 south" | ||

A new wave is gathering momentum. This autumn, the spotlights will be on men and their love affair with jewellery, in particular with cultured Tahitian pearis in dark mysterious colours. Men's jewellery will no longer be just an obsession of the minority few, but moving towards the centre stage of the fashion world. Ancient rulers, princes and noblemen ware lavishly adorned with pearls. Sadly, in our modern life in concrete conglomeration, this tradition of extravagance and exuberance has given way to sobriety and minimalism, leaving little space for colours and flamboyance in the life of men. |

||

|

||

But the wave has turned. A Tahitian pearl, with its intense colours and soft-glowing nacre, is the perfect gem to bring exuberance and flamboyance back to men's accessories. In response to this emerging trend, the international pearl company Golay launches for this autumn a collection of men's jewellery with cultured Tahitian pearls. Designed and made in Paris for the dynamic and the sportive, the collection "20 South" will be available in three nacklace designs and one bracelet design. 20 south is the geographical latitude where Tahiti is located.

The cultured Tahitian pearls are set in silver and mounted on caoutchouc straps. The standard colection features round pearls of 9mm to 10mm, but pearls of larger sizes in various shapes are available upon specific request. With accessories of their own, and particularly with Tahitian Pearls, men of the 21st century assert their sense of aesthetics and sensuality. |

||

| Russian jewelry Market | ||

Russians traditionally love jewelry, especially gold, the symbol of wealth and prosperity. And the Russian jewelry market is booming. Wealthy Russians can increasingly ofen be seen at European auctions and leaving as the surprise purchasers of exclusive pieces. Western jewelers are opening boutiques in Mocow one after another and are prospering. However, mass Russian consumers are oriented to the cheaper end of the market, meaning that the Russian jewelry market today has singificant potential for development. According to the Russian Guild of Jewelers, in recent years the sector has witnessed 30% production growth annually. Today, it is the most successful developing industry outside the raw materials sector. Some believe that this is due to the increase in real incomes of the population. Yet many experts agree that growth rates in recent years have been down more to the industry emerging from the "shadow economy" into the legal sphere. In compliance with the Russian law, the Central Assay Office must certify all jewelry, both foreign and domestic, before entering the market. Since the state abolished licensing in 2001 and excise taxes on gold and diamond production and sales in 2003 *in 2000 the tax rate was 43%(, it has become more profitable to produce jewelry legally. The abolition of sales tax in 2004 also contributed to increased output. The Guild's director general, Valety Radashevich, says that growth is driven not by high purchasing capacity, but by production becoming legalized and the gray merket shrinking. Market problems Although the government has done a lot to create the necessary legal basis for the industry's development, the judicial framework is still underdeveloped. The main shortcomings are the VAT calculation formula and restrictive export duties. According to Valery Rudakov, committee chairman at the Russian Chamber of Commerce and Industry, jewelers worldwide can buy precious metals for production without VAT and with payment delayed until finished products are sent to the shops. In Russia it is the other way round: VAT is 20% and payment should be made in advance, which makes products less competitive. Moreover, this year an amendment to the Russian Tax Code comes into effect that will raise state duties for assaying jewelry by two to five times. This may result in higher prices for Russian jewelry. What Russians buy In 2004, Russians spent almost $2 billion on jewelry in Russian jewelry shops. According to research firm Komkon, Spending on jewelry has increased by 5% in the last three years. Demand for jewelry is growing, as for other expensive durables, especially in Moscow. The main reason is that deposit interest rates in banks are almost yero relative to inflation, while the rates of foreign currencies are very unstable. Jewelry, however, remains a safe means of saving. Russian conumers of jewelry fall into two categories. Most buy mass-produced goods. These are people with a medium income and traditional preferences, and they usually trust Russian-manufactured jewelry. Mass consumers in Russia are offered mainly light-weight casting-earring, rings, pendants, and chains with an average weith of two and a half to five grams and suitable for a client of two and a half to five grams and suitable for a client with low purchasing capacity. The other group comprises people whose incomes are large enough to appreciate not only the metal the jewelry is made of, but also its brand and exclusiveness. This group usually prefers foreing-made jewelry. Imports The market for foreign jewelry in Russia is polarized. On the one hand, a huge amount of low-quality, cheap Turkish, Chinese and Indian goods are flowing in. On the other hand, in Moscow stores you can see high-quality earrings, rings and necklaces made in Italy, the global leader in jewelry production. The dynamic development of the Russian market has made it attractive for foreign companies such as Carrer, Tiffany &Co, Bibigi and others. Last year, foreign players continued to expand into the Russian market: Gilbert Albert opened a gallery, de Grisogno a boutigue, and the Privilegiya jewelry house a boutique that offers products from four European jewelry houses (Germary's Wellendorff and Gellner and Italy's Marco Bicego and Favero). The heads of these houses, Hans Peter Wellendorf and Mateo Favero, say that the Moscow market is now extremely attractive to all producers of luxury goods. It already has a class of consumers for such goods, and Russians are just as demanding and solvent as affluent buyers in Europe. Vyacheslav Tkachenko of Kosmos Zoloto, Bibigi's distributor in Russia, says that the demand for luxury goods is growing every year. Russian producers The leading Russian producers of jewelry are Moscow-based Adamas factory, with a 20% share of the market, and the Krasnoyarsk non-ferrous metals plant, with about 10%. The domestic industry is trying to keep up with the West. Radashevich of the Guild says that jewelry technologies in Russia are fully in line with internatinal standards, as all large firms have foreign equipment. "Jewelry production in this country has deep roots, and there is no lack of real masters. The quality of our jewelry is very high," he adds. Experts say that Russian producers are quite able make exclusive, high-quality pieces. Yet a crucial advantage in competition for buyers, apart from the quality, is a well-known brand name, which, however, Russian producers do not have. The Soviet and later Russian jewelry industry did not address branding at all, and it is only now that Russian producers and shop owners are beginning to make the first steps in this direction. An important trend in the sector's development is its ongoing restructuring, and the continuing formation of wholesale and retail chains. Major producers are setting up their own chains, especially Adamas and Almaz Holding. The latter owns a network of over 80 stores in all regions of Russia. Secondly, Russia is creating vertically integrated systems of production and sales. For example, the diamond producer Alrosa intends to create a company for the luxury jewelry market. It is expected to create a jewelry brand based on a retail network set up especially for this purpose. The first store is to open in Moscow later this year. Overall, the Russian Guild of Promoting Jewelry Trade says that jewelry production in Russia may grow by 20-30% annually, provided a number of administrative obstacles are lifted to allow the market to develop effectively. http://en.rian.ru/analysis/20050516/40362216.html Top ^ |

||

| GIA Gem laboratory expert explains identification techniques of natural and treated red, pink diamonds at AGA conferencet | ||

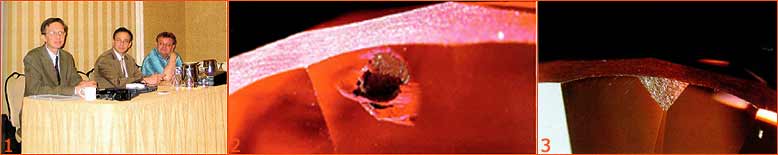

1 From left, Lucent Diamonds President Alex Grizenko, GIA's Christopher P. • Smith, and New Diamonds of Siberia's Research and Development Manager ^f Dr. Victor Vins discuss the Lucent treated-color pink-to-red diamonds at the i AGA conference in Las Vegas. (GIA Photo.) 2 A very coarsely textured graphitization of the diamond surrounding naturally occurring mineral inclusions and along associated stress fractures was commonly seen in many of the Lucent samples. The morphology of the mineral inclusions resembles that of olivine or garnet, which occur as inclusions only in natural diamonds; the metallic inclusions seen in many synthetic diamonds have a very different shape and appearance. Photomicrograph by C. P. Smith; magnified 62x. 3 Small, severely etched areas were present on or near the girdles of several samples, indicating that the damage caused by certain phases of the treatment process had not been completely removed by repolishing. Photomicrograph by C. P. Smith; magnified 50x. |

||

|

||

|

The allure of color and the beauty of diamonds have a powerful appeal for the gem-buying public, and demand for fancy-colored natural diamonds has increased sharply in recent years. Their availability, however, has remained very limited, especially in the highly prized pink-to-red color range. Natural-color diamonds with a dominant red color are some of the most sought-after and typically achieve very high per-carat prices when they come up at auction. The highest price ever paid per carat for a diamond at auction was the 0.95-ct. Hancock Red, which achieved an extraordinary $924,000 per carat. Even the expanded supply of pink diamonds from the Argyle mine in Australia has not satisfied the public's growing appetite for these fancy-colored diamonds, and reds have remained just as scarce and sought-after as ever. As a result, a variety of attempts have been made over the years to impart a pink-to-red color in diamonds. This has ranged from rather low-tech coatings to the application of more sophisticated combinations of treatment techniques involving irradiation with low-energy electrons, followed by annealing. Most recently the application of high-pres- sure/high-temperature (HPHT) technology has provided an additional method to create such color. Christopher P. Smith, director of Identification Services at the GIA Gem Laboratory in New York, gave a presentation on the identification of treated-color pink-to-red diamonds at a conference organized by the Accredited Gemologists Association (AGA) on June 3 in Las Vegas. The conference was chaired by Antoinette Matlins, a well known gemologist and author. Lucent Diamonds of Denver, Colo., a longtime producer of HPHT-grown synthetic diamonds and has dealt extensively with the application of HPHT treatments to modify the color of natural and synthetic diamonds. Working in partnership with New Diamonds of Siberia and their Research and Development Manager, Dr. Victor Vins, Lucent has developed a unique multiple-step procedure to treat natural, type la diamonds. The result is colors that range from brown to purple and pink-to-red through HPHT annealing, irradiation, and low-pressure annealing at relatively low temperatures. Those diamonds that result in a pink to red color are sold under the trade name "Imperial Red Diamonds." Lucent President Alex Grizenko began the conference with a brief history and evolution of the treatment process, also covering future production capabilities and marketing plans. Grizenko pointed out that all Lucent-treated diamonds (other colors besides red are produced) will be fully disclosed, including a laser inscription. Grizenko was joined by Vins, for whom he interpreted, in answering questions about the technology behind the treatment. Both Grizenko and Vins described some of the complications involved with their treatment procedure as a result of the HPHT conditions-temperature above 2,150°C ana a pressure of 70 kilobars - so Lucent uses primarily higher clarity stones. Those that survive end up with clarity grades in the VS2-SI1 clarity range, said Grizenko- "Color is usually created at the expense of clarity." He added that the treated diamonds are cut shallow to maximize their color. Several of the Lucent diamonds were available for viewing by conference participants, along with natural pink diamonds supplied byArgyle Diamonds, Ltd. Joseph Casella, Argyle's senior sales executive for Europe and the U.S., led the team of Argyle representatives at the conference. Smith co-authored an article on treated-color diamonds in the Spring 2005 issue of Gems & Gemology ("Treated-Color Pink-to-Red Diamonds from Lucent Diamonds, Inc."). It provides a detailed scientific report on the treatment process, including charts and many photomicrographs illustrating characteristics resulting from the treatment that are used in identification. Grizenko provided Lucent diamonds for use in researching the article and was consulted, along with Vins. "The process used by Lucent is a stable and permanent treatment," said Smith, "and no residual radioactivity was detected." He added, "Several standard gemological properties and characteristics, as well as advanced analytical techniques, will readily identify these diamonds as treated-color, natural-origin diamonds." Smith explained the distinguishing characteristics of the Lucent Imperial diamonds, based on GIA's research, and he illustrated with side-by-side photomicrographs and spectra comparing treated-color and natural-color diamonds. These characteristics include etched surfaces, graphitized coating on mineral inclusions, color zoning, strain patterns, fluorescence, visible luminescence, and spectroscopy. A detailed discussion of how these characteristics are used to identify these HPHT treated-color diamonds follows. Etched surfaces: Areas around the girdle/pavilion that had not been repolished after treatment showed evidence of severe etcnmg. This is a clear indicator of HPHT treatment, said Smith. "Etch features were also evident in surface-reaching cleavages or fractures," he noted, adding that etching creates a coarse or granular appearance on the surface of the stones and along fracture walls. Graphitized coating on mineral inclusions: "When diamonds are taken to these temperatures and pressures, it is common for the diamond's surface (both external and internal-surrounding includes minerals and fractures) to partially convert to graphite. "The texture, color, and appearance of these inclusions are very characteristic," said Smith. In addition, the conversion to graphite requires about 30 percent more space, so internally, the resulting pressure it exerts may cause additional stress fractures around included crystals or as extensions of existing fractures," said Smith. Color zoning: This is especially useful for identification, said Smith. "Color concentration is one of the most distinctive characteristics of this treatment." As he showed several illustrations, Smith said, "purple and pink-to-red color concentrations often occurred with brown concentrations and regions that were near-colorless." This type of color zoning is not consistent with naturally colored diamonds, Smith said. He also mentioned that no color concentrations were observed at the culet. Strain patterns. Smith said the most commonly banded strain patterns were observed, showing a low degree of internal strain. Some showed a higher degree of strain, with a combination of banded and mottled patterns, he said, while others revealed a high degree of internal strain. Fluorescence: Another very diagnostic feature for the identification of these treated color diamonds was their characteristic fluorescence reaction to both long-wave and short-wave UV light. The Lucent diamonds exhibited chalky fluorescence to long-wave UV, usually in combinations of yellow, green, and orange. Under short-wave UV, they showed medium to strong orange fluorescence, commonly with weak yellow zones, Smith said. Visible Luminescence: Smith said prominent green visible luminescence was typical, and it resulted from high concentrations of H3 centers (an absorption feature at 503 nm). Orange-red visible luminescence was also seen, and was caused by the nitrogen-vacancy defect (N-V)- center positioned at 637 nanometers (nm). Yellow visible luminescence was due to the (N-V)O center positioned at 575 nm. Spectroscopy: In its research, GIA used several spectrometers to identify the occurrence and concentration of various defect centers to identify the presence of the treatment. These included Raman photoluminescence (PL), Infrared, and UV/Vis/NIRspectroscopy. Within the infrared region, it was shown that the diamonds were originally type la, containing nitrogen in various states of aggregation. The HPHT steps of the treatment process facilitate the de-aggregation of nitrogen defects, resulting in single substitutional nitrogen (IB component), as well as other defects, while the subsequent high-energy electron irradiation and relatively lower temperature annealing provide a further reconfiguration of defects to produce the necessary color-causing centers. Low temperature Raman PL and UV/VIS/NIRspec-troscopy further revealed a series of strong absorptions of N-V centers at 637 and 575 nm, 594, H3/H4 at 503, and 496 nm, N3 at 415 nm, as well as others, the combination of which Smith indicated has never been found in natural-color diamonds. Smith said the GIA Gem Laboratory issues a GIA Gemological Identification Report, not a GIA Diamond Grading Report or Diamond Dossier®, for Lucent treated-color diamonds. Following Smith's presentation, conference participants examined natural-color and treated-color diamonds using microscopes, a spectroscope, and a UV lamp provided by GIA Instruments. Smith, Grizenko, Vins, and representatives of Argyle assisted and answered questions. All of the diamonds used in the hands-on part of the conference were provided by Lucent Diamonds and Argyle Diamonds. Top ^ |

||

| Watches |

|

1 Harry Winston: Opus 4 CASE: in platinum, rounded shape, 180 degree rotation on sides. DIAL: see-through sapphire glass front, baton hands and Arabic numerals lacquered and hand-engraved back with large moon phases, analogic date, baton hands and Arabic numerals. MOVEMENT: self-winding with time functions on reverse dials, 53 hours of power reserve. FUNCTIONS: date and moon phases, Westminster minute-repeater (hour, quarter hour, minutes) and Tourbillon. |

|

|

2 Tiffany&Co,: Tonneau CASE: in platinum, tonneau shape, set with diamonds (1.92 carats). DIAL: white, baton hands and two Arabic numerals at 6 and 12 o'clock. MOVEMENT: electronic quartz. FUNCTIONS: hours and minutes. |

|

|

3 Bulgari: Bulgari-Bulgari Platinum CASE: in platinum, round shape, sapphire crystal case back with visible mechanism, bezel with engraved dual brand name. DIAL: silver-plated, baton indexes and hands, large Arabic numerals at 6 and 12 o'clock. MOVEMENT: self-winding Swiss Made. FUNCTIONS: centre seconds hand, calendar |

|

|

4 Vacheron Constantin: Toledo 1952 CASE: in platinum, carree galbe shape. DIAL: slate colour, baton hands, baton indexes alternating with Arabic numerals, analogical date, digital day and month, dial for small seconds and moon phases. MOVEMENT: self-winding, 40 hours of power reserve. FUNCTIONS: small seconds, date, day, month and moon phases. |

|

|

5 Cartier: Tank Chinese CASE: in platinum, rectangular shape, bezel with brilliant-cut diamonds. DIAL: silver-plated, baton hands, Roman numerals, "chemin de fer" motion work. MOVEMENT: self-winding. FUNCTION: hours and minutes. |

|

|

6 Jaeger-LeCoultre: Re-verso Platinum Number Two CASE: in platinum, reversible and rectangular shape, sapphire crystal back is showing the Tourbillon device. DIAL: in gold, two colour shading in silver and ruthenium, baton hands and Arabic numerals, dials for the small seconds hand and power reserve. MOVEMENT: mechanical, crafted, assembled and decorated by hand, 45 hours of power reserve. FUNCTIONS: small seconds, power reserve and Tourbillon. |

|

|

7 Franck Mulier: Long Island Crazy Color Dreams CASE: in platinum, rectangular shape, bezel decorated with diamonds. DIAL: blue, in guilloche with lacquered finish and mother-of-pearl, Stuart hands, large coloured and irregular Arabic numerals. MOVEMENT: self-winding with a "jumping" hours, rotor in platinum. FUNCTION: hours and minutes |

|

|

8 Rolex: Cellini Ceilinium CASE: in platinum, rounded shape. DIAL: black, baton indexes and hands, motion work with indexes and Arabic numerals, small seconds counter at 6 o'clock. MOVEMENT: mechanical. FUNCTIONS: small seconds. |

Top ^