| |

Bulgari presents elegant new collections |

|

| |

The addition of elegant new creations makes Bulgari's "Astrale" jewelry collection even richer than before. An all—en—compassing luminosity is the common thread that links the ring,

necklace and earrings of this new parure. The Astrale collection

has always played on the combination of circular elements encrusted in diamond pave. With this new set, the use of diamonds

of different sizes mounted on elements that sinuously follow the

movement of the body enables the stones to fully express their

luminous energy.

|

|

| |

|

|

| |

A), B), C) Bulgari - Astrale collection

D), E), F) Bulgari - Cocktail collection |

|

| |

Bulgari also presents the nevv "Bulgarl Cocktail

Collection," which finds inspiration in the chromatic jux-

tapositlons and play of volumes of the stones for young,

fresh and exuberant jevvelry creations. Amethyst, turquoise,

peridot and coral, embellished by diamond pave, gener-

ate vivid chromatic effects, vvhere the contrast between

opaque and translucent stones evokes the rich and lively

sensory realm of the Mediterranean. Bulgari continues to

experiment vvith imaginative cuts, like the small cones that

are individually shaped to create a perfect balance vvith

the overall design of the jevvel.

www.bulgari.com

|

|

| |

Piaget shows at Paris |

|

| |

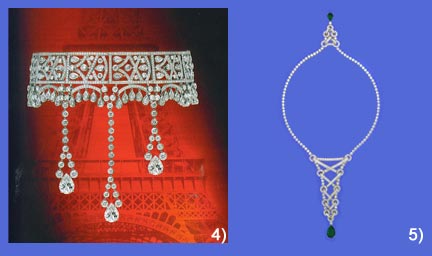

Swiss jeweller Piaget's first participation in the Biennale des Anti quaires at Paris over September 15-22, 2010, is a natural continuation of

the brand history. Piaget is presenting 60 Haute Joaillerie models inspired by the world of Haute Couture.

Since 1962, when the first Biennale, or Antiques Fair, was held in Paris, the Grand Palais has regularly welcomed, once very two years, one

of the finest international art events. Pierre \/andermersh, president of the National Union of Antique Dealers, first had the idea of this event in the late

1950s. The support of Andre' Malraux, the iconic Minister for Cultural Affairs

under General de Gaulle, enabled him to bring his project to fruition.

|

|

| |

|

|

| |

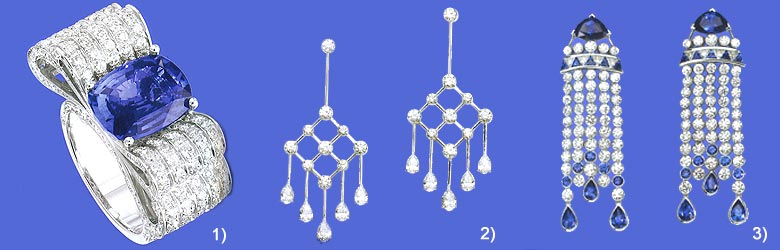

1) Piaget - 18K White gold ring set with 293 brilliant-cut diamonds, & 1 cushion-cut blue sapphire

2)

Piaget - 18K white gold earrings set with 20 brilliant-cut diamonds, & 10 pear-shaped diamonds.

3) Piaget - 18K White gold earrings set with 102 brilliant-cut diamonds, 8 triangle-cut diamonds, & 28 fancy-cut blue sapphires |

|

| |

The Grand Palais is undoubtedly one of the world’s most prestigious

exhibition centres. The Biennale is spread over a 13,500 square metres

within the Palace of Fine Arts. The Piaget booth is located right in the middle of the Ailes des Joailliers, Jewellers’ Avenue, at the centre of the Grand

Palais beneath the 45 rnetre—high glass dome. "The Biennale has become

an inescapable venue for jewellers from around the world

and Piaget naturally finds its place there. We are taking

part for the first time this year with 60 models illustrating

the brand’s creativity and the skill of our artisans,“ said

Philippe Leopold-Metzger, CEO Piaget. |

|

| |

The preview evening of the Biennale des Antiquaires is one of the most elegant events on the international social calendar. The greatest art and jewellery dealers

welcome collectors who flock from around the worfd to view,

to admire and to purchase the rarest objects. At Piaget,

the preview takes place every day. But the cocktails and

delicious nibbles will be composed of the most precious

ingredients. In a showcase on the right-hand side of the

booth, diamonds and colourful gemstones will be set on a

series of jewellery creations.

A second showcase will feature some of the

most complicated men’s watches born in Piaget’s Geneva

workshops, thus providing a perfect expression of the twin

fields of expertise mastered by Piaget. Haute Horlogeri·

and Haute Joaillerie.

|

|

|

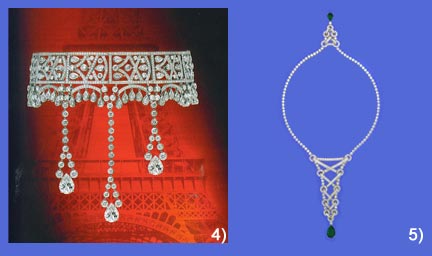

4) Piaget - 18K White gold necklace set with 1098 brilliant-cut diamonds, 48 pear shaped diamonds, & 3 centre pear-shaped diamonds

5)Piaget - 18K white gold necklace set with 426 brilliant-cut diamonds, & 2 pear-shaped emeralds. |

|

|

| |

|

|

| |

Ruby and Sapphire Markets Transformed, Adapted by Russell Shor, GIA senior industry analyst, © Gemological Institute of America. All rights reserved May 2010. |

|

| |

|

|

| |

|

|

Ruby and Sapphrre are among history's most coveted gems, with fashioned stones dating back to ancient Greece, India. and Asia. Traditionally, they have been scarce and expensive. The past 25 years, however, have brought radical changes in the market for rubies and sapphires, stimulated by huge increases in supply.

Today, they are much more readily available in a full range of prices. This is because of the discovery of large deposits around the globe and the development of treatments that could consistently transform unattractive material into beautifully colored gems. By 2009, ruby and sapphire accounted for about

one-third of all colored stone and pearl sales worldwide.

The lead article in the Winter 2009 issue of Gems & Gemology (figure 1), Russell Shor and Robert Weldon’s "Ruby and Sapphire Production and Distribution: A Quarter Century of Change," chronicles these new sources and treatment methods and how they coincided with new sales outlets, such as television and online shopping. lt also examines how corundum supplies and prices have been buffeted in recent years by political events and social concerns. |

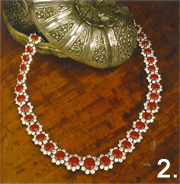

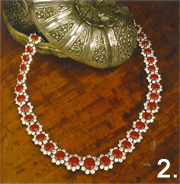

Figure 1 : The lead article in the Winter 2009 issue of Gems & Gemology was Russell Shor & Robert Welden's review of Ruby & sapphire developments over the past 25 years. The sapphire necklace, designed by David Webb, contains an 80.77 cabochon & approximately 700 carats of sapphire beads. Courtesy of brice Jewelers, Houston; photo by Robert Weldon, © GIA |

|

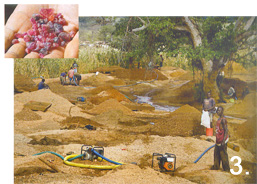

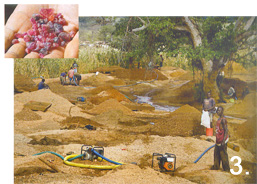

Myanmar (formerly Burma) has been at the center of the ruby story for centuries. The ancient Mogok deposits, the traditional source of the world's tinest material, have continued to produce, while a new discovery, Mong Hsu, began to yield large quantities of commercial material during the mid-1990s. By the early 2000s, the country was supplying an estimated 90% of the world‘s rubies (figure 2).

Other sources - Kenya, Vietnam, and Magascar - also began to supply the market, and ruby became fairly plentiful during the 1990s and early 2007, fine stenes began to emerge from a new Iocality in Winza, Tanzania (figure

3). Prices for medium- and commercial guality material eased considerably, and

with larger supplies available at attractive prices, designers began to turn out

lines of mass-market ruby jewelry. |

|

|

Figure 2. Rubies are among the most sought-after gems, & Myanmar is the historic source of the finest rubies. This necklace is set with almost 84 carats of unheated Burmese rubies; countesy of Mona Lee Nesseth Custom and Estate Jewels & a private collector; photo by Robert Weldon, © GIA

Figure 3. In the Winza, Tanzania ruby deposit, miners use gasoline-powered pumps to make pools of water for sieveing the gem-bearing gravels during period of low rainfall. June 2008 photo by Brendan Laurs, © GIA |

|

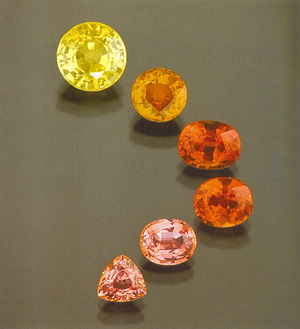

Changes in the sapphire market have been even more profound. While

traditional sources such as Kashmir, Thailand, and Cambedia were becoming

mined out, new production from Sri Lanka, Australia, Madagascar (figure 4), and

(briefly) the US state of Montana poured into the market.

In earlier times, much of this material would not have been mined because it was either too pale (Sri Lanka) or too dark (Australia), or had a less-commercial

color (Madagascar). But gem dealers, primarily in Thailand, perfected heat-treatment precesses that could consistently improve the colors of these goods.

Thus, millions of carats of previously unusable sapphire were transfermed into

attractive gems. |

|

|

| |

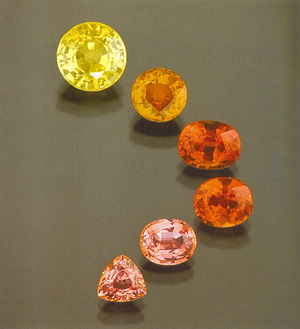

The treatments, while a boon to the gem market, were alse contreversial,

primarily because many dealers failed to disclose them to buyers. In time, the

trade generally accepted straight heat treatment - subjecting ruby and sapphire to

high temperatures under controlled atmospheric conditions. But in 2001 , treaters

took that process one step further, creating a furor that resounds today.

That year, an abundance of pinkish orange "padparadscha" sapphires

entered the market. Because such sapphires are normally quite rare, the sheer quantity of these stones prompted gemologists and dealers to suspect a new

form of treatment. Eventually they discovered that beryllium was being diffused

into the stone during the heating process, radically. altering the perceived color.

Beryllium diffusion was subsequently used to modify blue and other colors of

sapphire (figure 5), as well as ruby, expanding the controversy and attracting a

spate of negative press reports.

|

|

|

Figure 4. Sapphires from Madagascar (here, 0.45-1.99 ct) are notable for the broad range of colors produced. Courtesy of Robert Kane/Fine Gems International; photo by Robert Weldon, © GIA |

|

|

| |

Also impacting the market were the large quantities of attractive ruby

that began to show up in the early 2000s. Much of the material, it was quickly discovered, had been filled with lead glass

to conceal abundant fissures in cloudy pink sapphires that were otherwise unsuitable for

gem use. Fortunately, this treated material is easily identified with magnification.

lnternational politics also affected the ruby and sapphire trade. To censure Myanmar for human rights abuses, the US Congress enacted the Burmese Freedom and Democracy Act in 2003, which banned trade in gems and other products from that country. But the ban left a huge loophole that allowed the import of gemstones if they had been cut ln a third

country. The vast majority of Burmese gems were cut in neighboring Thailand, so the ban had little real effect. |

|

| |

|

As repression in Myanmar increased, how-ever, the Eurepean Union enacted its own

ban on Burmese gems, followed in 2008 by a tightening of the US measure that effectively banned all Burmese ruby and jadeite imports regardless of where they

were cut.

As a result, mere than 50 ruby mines closed down in Myanmar, while

buying by fereign dealers reportedly fell by more than half in the latter part of 2008.

The need to identify which rubies were Burmese highlighted another

issue; country of origin. Colored stones from certain localities, such as Mogok

ruby and Kashmir sapphire, have traditionally commanded the highest premiums.

Although many feel that gemstones should be judged by individual beauty rather than source, recent technological advances have given laboratories the tools

needed to make more accurate country—of—origin determinations.

As Burmese rubies were being removed from the market, Madagascar, the world's largest sapphire producer in the mid—2000s, abruptly banned export

of all rough gem materials in early 2008. A Thai delegation visited the country to

negotiate an end to the embargo, but failed to secure an agreement. The ban

was lifted in mid-2009 after a coup toppled the president. By then, however, the

number of miners working the vast llakaka sapphire deposits had shrunk to one-

fourth its peak.

|

| Figure 5. This group of beryllium-diffused sapphires (1-2 ct) is typical of the colors seen on the market. GIA Collection no.30858; Photo by Robert Weldon, , © GIA |

Despite these challenges, demand for ruby and Sapphire grew strongly during the 1990s and into the 21st century. One 2009

study reported that they accounted for almost

one-third of the US$10.3 billion worldwide retail

market for colored stones and pearls. A second

2009 study, by mining company True North Gems, broke the numbers down further: ruby accounted for US$2.1 billion, sapphire US$800

million (with US$58 million of that pink sapphire).

Note that sales figures for sapphire are lower

because of the vast quantities of inexpensive lesser-quality and diffusion-treated material

in the market. By compariscn, emerald sales

totaled US$1.4 billion.

Looking to the future, the colored stone

trade goods that meet standards of safe working conditions, fair economic returns to miners and their communities,

and environmentally sustainable practices. A number of industry organizations

are working with mining operations and gem dealers to hasten progress toward

these goals.

The future of the corundum market depends on finding new, economic

ruby and sapphire deposits. But, the trade's understanding of treatments, and

willingness to disclose them will grow ever more important in maintaining consumer

confidence, as will awareness of consumers’ desire to own beautiful products

that embody positive social, ethical, and environmental values. |

|

|

|

| |

Addendum to the SSEF Keshi cultured pearl trade alert; May 2010...and what happens with the beades cultured pearls? by Dr.Michael S.Krzemnicki, gemlab@ssef.ch

|

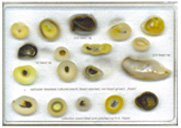

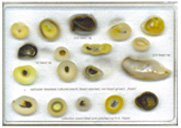

Following our recent press release on beadless

cultured pearls (also called "Keshi" in the trade), we received many positive reactions from the trade.

As there were also questions about beaded

cultured pearls, we would like to inform the trade, that developments in pearl cultivation is not only restricted to the

beadless cultured pearls ("Keshi"), but also includes the use of new bead materials in cultured pearls.

We have encountered so far the following "new"

beads, especially used for pearl cultivation in Pinctada

maxima (SiIverlipped and Goldlipped pearl oyster):

1) Beadless saltwater cultured pearl ("Keshi")

used as a bead to produce a cultured pearl

2) Beadless freshwater cultured pearl from China

used as a bead of a cultured pearl

3) Beaded saltwater cultured pearl used as a

bead of a cultured pearl - and most recently,

4) Natural

saltwater pearl used as a bead of a cultured pearl

Why new beads are used?

These last developments show that there are some individuals who purposely try to produce cultured pearls with internal structures to be confused with natural pearls. Again, as for the beadless cultured pearls ("Keshi"), most of these pearls come with reports as natural pearls. However we can say, that they are certainly only in a very limited amount on the market, contray to the beadsless cultured pearls ("Keshi") described in our last press release. But this may change in the future. |

|

|

Typical selection of these beadless cultures pearls from the Pinclada maxima (South Sea) |

|

Necklace of beadless cultured pealrs of an almost perfect appearance, tested recently at SSEF |

|

|

Cross sections through different kinds of saltwater beadless cultured pearls |

|

Necklace of beadless cultured pealrs of an almost perfect appearance, tested recently at SSEF |

|

SSEF identifies these pearls as beaded cultured pearls

The SSEF has been investigating these beaded cultured pearls for some time in detail (see Hanni, Krazemnicki & Cartier in the upcoming issues of the Journal of Gemmology and Zeitschrift der Deutschen Gemmologischen Gesellschaft).

Our research revealed some intriguing external

features, which in combination with radiography and micro

x-ray tomography enable us to distinguish these cultured pearls with "new" beads from their natural counterparts.

To face these and future challenges in pearl identification, the SSEF is investing rnuch effort in pearl research.

By constantly adapting its analytical rnethods accordingly

and by regularly communicating its results to the trade and gemmological laboratories, we are confident that we are taking all necessary measures to protect the natural pearl

trade as far as possible.

To learn more about these issues, the SSEF offers

a highly specialized pearl course, where you learn in detail how natural pearls and cultured pearls are forming and

how they can be separated from each other using all

current analytical tools, including radiography and micro

X ray tomography. |

|

| |

SSEF Certificate |

|

|

|

|

|

|

| |

| |